Climate Dialogue

Climate change is fundamentally reshaping our world and the global economy. Recognizing this, more than a hundred countries – including Switzerland – ratified the Paris Agreement in 2017. This sets our normative basis for our actions as investors.

Our expectations

We expect all companies contained in our members’ investment portfolios to transition their business and transform their product portfolio, production processes and own operations in such a way that they will meet the goals of the Paris Agreement. To succeed, companies need to have:

- Clarity on all risks and opportunities arising from the transition to a low-carbon economy and the physical impacts of climate change.

- Targets: Tangible short- and medium-term GHG emission targets based on science and validated externally.

- Strategy: A plan that enables the achievement of these targets through appropriate capital allocation, R&D spend and new products.

- Leadership: Climate-related knowledge and clear accountability at board and senior-management level, combined with financial incentives linked to GHG emission targets.

- Transparency: Reporting in line with TCFD guidance.

Further information on our position: Climate Stewardship Policy .

Strategy

To prioritise engagement dialogue, we apply a risk-based approach as recommended by the OECD. This means prioritising companies with high emissions and poor climate risk mitigation. We weigh these material factors against the potential for influence and the available resources.

Global collaboration

To lend more weight to our voice, we are also joining Climate Action 100+, an alliance of international investors and – with over 600 participating institutions – currently the largest investor coalition on climate issues. Its purpose is ‘to ask that the world’s largest corporate greenhouse gas emitters take necessary action on climate change’.

In accordance with its own expectations stated above, SVVK-ASIR fully supports the Climate Action 100+ Signatory Statement and phase II of the collaboration (2023–2030).

Escalation path

Where dialogue does not lead to any results, we dispose of a number of insturments. A more detailed description is available in our Climate Stewardship Policy .

- Senior-management or board-level outreach, individually or in coordination with other investors.

- Voting and filing: SVVK-ASIR may support its members in exercising their shareholder rights by providing information on annual general meeting votes or climate-related shareholder resolutions.

- Exclusion recommendations: If a company refuses to engage constructively and makes insufficient progress towards the engagement goals the SVVK-ASIR Responsible Investment Committee may issue an exclusion recommendation. This step is preceded by a final letter to the company and decided by majority vote.

Activities

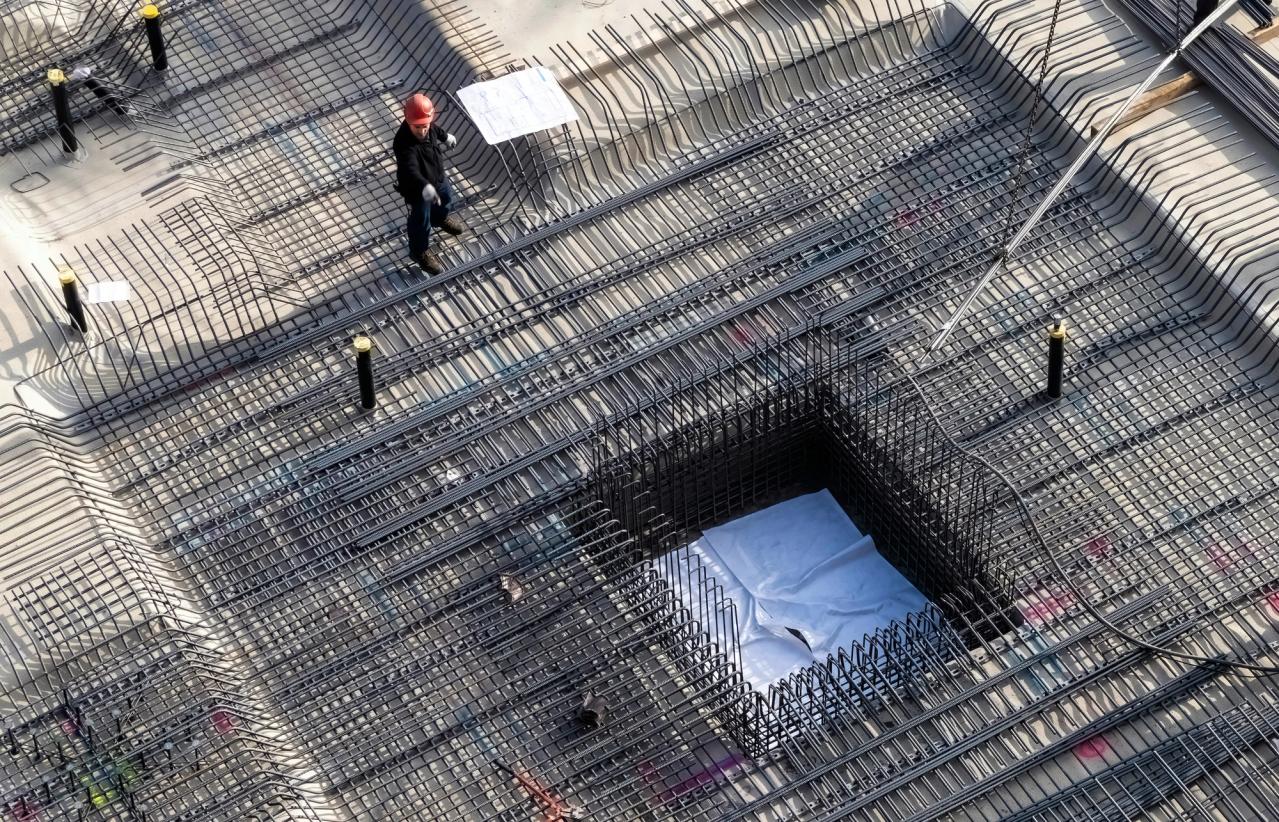

Since 2018, SVVK has continuously expanded its climate dialogue, starting with the industries that are central to the climate transition - steel, cement and energy. In 2023, SVVK started its own engagement with providers of Swiss real estate funds. In 2024, SVVK expanded its climate dialogue with the most carbon-intense industries and integrated the issue of biodiversity loss, a key driver of climate change.