Biodiversity

A credible climate change strategy requires the issue of biodiversity to be addressed. Intact ecosystems are a defence against climate change - and their loss is one of its main drivers. SVVK-ASIR seeks to engage with business on this issue through three partnerships.

An invisible process

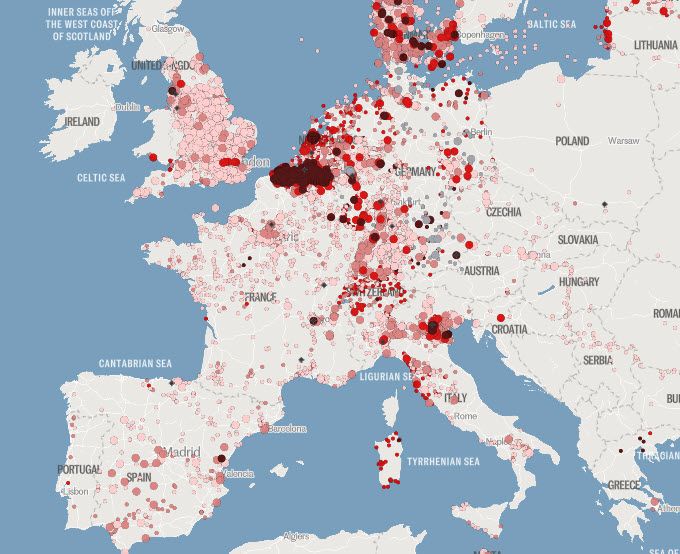

Humanity is highly dependent on natural resources and the services provided by intact ecosystems: they make soil fertile, clean and store water, ensure pollination, protect against erosion and extreme weather events, and provide countless other, often invisible, services. The expansion of human settlements and transport routes that fragment the land, as well as intensive, nitrogen- and pesticide-rich agriculture, put pressure on water, soil and biodiversity. As a densely populated country, Switzerland is particularly affected. This is exacerbated by climate change, which acts as an accelerator.

If the ecosystem begins to falter, services that we previously took for granted may no longer be provided adequately, or only at significantly higher costs. In addition, the cost of damaging events increases as the ability of ecosystems to regulate themselves diminishes. This has implications for businesses, property and other tangible assets in investors' portfolios. These transitory and physical risks, as they are known, affect the long-term value of investments and are often difficult to quantify due to the complexity of ecosystems. The costs of inaction are rising, however, and by 2050 are estimated to reach CHF 14 to 16 billion for Switzerland alone (FOEN).

Our expectations

The companies in our members' portfolios are already affected by the loss of ecosystem services. This applies not only to the food sector: other sectors are also directly dependent on nature, for example for new medicines. Often the risks are hidden in the supply chain and manifest themselves gradually. The same applies to the negative impact of their activities on nature.

That is why we expect all companies in our members' portfolios to understand, assess and subsequently disclose their risks to nature. Where significant risks are identified, we expect them to take concrete steps to minimise these. This applies to their own operations, but also and in particular to dependencies and impacts in the value chain, because loss of biodiversity is also a major risk for investors such as pension funds and social insurance funds. In its Risk Report 2024, the World Economic Forum (WEF) concludes that biodiversity loss, along with ecosystem collapse, is the third largest global economic risk over the next decade.

Biodiversity Case Studies

Partner for Biodiversity

With our expectations, we join a growing coalition of global investors who share our concerns and are calling on companies to better integrate nature. SVVK-ASIR has been supporting the FAIRR initiative since 2023 and also supports the newly established investor coalition, Nature Action 100.

At the beginning of 2024 we embarked on a new partnership with Robeco to deliver on our global biodiversity engagement.

We also support the World Benchmarking Alliance's «Investor Statement on Nature», which calls on companies to identify, assess and disclose their impacts and dependencies on nature.

Biodiversity Engagements

Together with our partner, we are conducting a dialogue on nature and biodiversity with the companies listed below.